Time is Money

At NextGen Benefits, we have seen it all in benefits.

This guide is to help new businesses evaluate different employee benefits options.

Book an appointment with a skilled employee benefits advisor online today. We look forward to assisting you with your benefits plan.

Why do it?

The first question to answer as an employer is, why do it….

Why provide employee benefits…

Why incur another expense to your bottom line?

After all, you have been surviving all this time without it.

The answer-- it’s not an expense, it’s an investment. Employee benefits are an investment!

The right employee benefits program will:

- Increase productivity

- Improve retention and attraction

Having the power to improve productivity might seem far fetched at first blush. But imagine an employee who leaves early because of crushing migraines, or an employee who can only lift half the weight because of a bad back, or maybe even an employee who is distracted at work because they are going through a hard divorce.

These are valuable hours of output lost, profits slip, and the company and employee are worse off.

These are valuable hours of output lost, profits slip, and the company and employee are worse off.

Employees can be better supported with the right employee benefits program. An employee who gets crushing migraines can be supported by the right medication. An employee with a bad back is strengthened through paramedical services like chiropractic, massage therapy, and physiotherapy. An employee who is personally distracted by a bad divorce is centered through a meaningful employee and family assistance program (EAP).

An employee benefits program will increase productivity by having employees working at full capacity.

The right employee benefits plan is a key ingredient to attracting the best employees.

Now we aren’t disillusioned enough to think that a benefits program is the silver bullet for flawless retention and attraction, but we know it helps.

If you have a spouse and young children, you’re trying to make mortgage payments and keep up with new expenses on little sleep. Knowing that dental cleanings and eyeglasses are covered is a HUGE relief.

If you are young and new to your job, nothing will get your parents off your back faster, and believe you now have a career than saying you have benefits!

And finally, if you are over 45, things like maintenance medications for things like high blood pressure can become a reality. Knowing that your employer has you covered for these medications heightens your loyalty and appreciation towards them.

For reasons like these, recent industry surveys have found that 4 of 5 employees only want to work for an employer with an industry-leading benefit.

Now to take it a step further, imagine losing an employee of two years to a competitor who had a benefits program. What have you really lost?

- You’ve lost a productive team member and their output.

- And you’ve lost the hours of time you spent training them, the money you spent compensating them when they weren’t fully productive yet.

- You’ve lost the money spent on recruiters and job postings hiring them in the first place.

- And now you have to do it ALL over again just to get back to equal.

You’ve lost a lot!

Now, what if you had the right employee benefits program in place that made your employee feel cared about, respected, and appreciated… the kind of program that had their peers recognizing their job as a worthwhile career… and the kind of program that protected and secured their family’s well-being? They might stay, and if they do the cost of the benefits program would be worth it thousands of times over.

The right employee benefits program is not an expense it’s an investment.

Designing The Right Benefits Plan

When an architect is building a home there are several standard questions they need answered.

How many occupants? Their ages? Their health? Their likes and dislikes? Time they plan to live in the house?

These answers ensure the architect don’t build a 3-bedroom bungalow for the cast of “19 Kids and Counting”. Or a house with standard-sized doorways for Shaquille O’Neal.

The answers, in other words, ensure the house makes the occupants feel comfortable, healthy and happy as long as they live in it.

Employee benefits are no different.

You need to understand all the factors that will influence the proper design of your program, including:

- Industry

- Size

- Number of years in business

- Competitors

- Benefits programs standards in your region

- Demographics of your employees

- Age

- Married/common law, children, single

- Stage in life

- Gender

- Occupations

- Lifestyle of employees

- Direction of your company

- Growth/expansion

- Stable

- Downsizing/leaning out

- Purpose for a benefits program

- Retain and attract quality employees

- Peace of mind

- Be competitive in your industry

- You feel you have to

Maybe you’re reading this and you’re thinking: Taking all this into account seems like overkill, I should just get a plan like my friend Bob — he’s happy.

Maybe for the same reason, you don’t drive the same car as your friend Bob, or eat the same thing for lunch, or date the same people, or well… I think you get it.

A little bit of work up front will save you and your employees in the back end.

NextGen Benefits advisors have been in the industry since 1981 and have worked with companies across Canada. We know that when a company's plan is misaligned their employees suffer.

If you have a one-size-fits-all mentality, your company and employees will suffer from:

- A benefits plan that doesn’t meet the needs of employees and their families

- Employees not appreciating and not understanding their benefits program

- Higher than necessary costs

- Unpredictable & high increases at renewal

- A benefits program that doesn’t easily evolve/change with you and your employee's needs

The right benefits plan is possible, but it takes a strategic and customized approach - do not settle for the same plan as Bob because…after all, you aren’t Bob!*

*unless your name is Bob, then you are Bob… in which case replace the name Bob with Steve

How to Determine your Budget for a Benefits Plan

Since the dawn of benefits programs, insurance reps, advisors, agents, and brokers have held overly complicated discussions with their clients and prospects on what a budget for a benefits program should be.

They’ve enlisted everything from calculus to moon cycles, to astrology signs, to what they think you’d be willing to pay them.

Maybe some of their methodologies have grains of truth… but you don’t have the time to waste negotiating an answer.

The answer…simple, straight-forward, most employee benefits programs cost… 5%-7% of your payroll.

Dealing with thousands of companies since 1981 this is the % that has yielded the best results for NextGen Benefits clients.

If you have 5 employees and pay them each $50,000/year, your total payroll is $250,000/year.

Then the budget for your benefits program should be around $12,500--$17,500/year TOTAL or about $2,500 --$3,500/employee/year.

Is this written in stone as the be-all and end-all for benefits budgets? ABSOLUTELY…NOT

Some companies need to have a richer program for retention and attraction… others need to scale back for the economic times… it all depends but it is often a helpful guideline that has served our clients well.

If 5%-7% of payroll is too high here are some tips that can help lower that amount:

- Scale back and/or remove the benefits that your employees care less about

- Have employees contribute part of the premium

- They can contribute up to 50% of the total cost

- Forgo a raise for inflation with employees to pay the benefits program

- A more tax-effective option than having employee contribute because the premium is a business expense for the company but a taxable

- Consider alternative benefits programs

- Healthcare spending account

- Hybrid plans

The truth is, if you think a benefits program will help you and your employees, something is available at almost any budget.

We aren’t saying you can get a Ferrari at Ford Fiesta prices, but you probably don’t need a Ferrari, especially when a Ford Fiesta will get you where you need to go.

Don’t let the fear of not providing the top tier benefits program to your employees stop you from providing anything if they will value it… something is always better than nothing to gain employee satisfaction and loyalty.

Think about Stable Long-Term Costs of your Program

On average the price of benefits programs can increase 10%-12% each year!

If that doesn’t seem like a lot to you, recognize that in 5-7 years, your costs could double.

That is wild!

We doubt, in your business, you can increase your customer’s costs by 10%-12% each year and be lucky enough to keep them as clients.

This is so outrageous that a benefits company could do nothing to gain any new business, lose 5% of their clients and they would still see revenue growth of 5%-7%.

If you aren’t thinking with your business mind, this doesn't pass the smell test. Setting your employees up in an unsustainable plan is not right and doesn’t work long-term.

If your costs grow past your budget you will need to reduce coverage or cancel the program, both of which, will undoubtedly upset employees - this is their compensation and they and their families place a high value on benefits.

Bottom line: Your benefits program needs to be sustainable.

So how do you do it?

At this risk of sounding like salespeople… and we hope you understand… we can’t give away the exact details as to how we do it… our competitors frequent our site (caught you! ).

What we can tell you is: NextGen Benefits can keep client benefits programs at a manageable average increase of 4.5%.

The 'other guys' are stuck delivering yearly double-digit increases.

If you want to better understand how NextGen Benefits can deliver a sustainable plan that your employees will love, book an appointment or email us at advisor@nextgenbenefits.ca.

We can't post all of our secrets!

How to Compare Benefits Plans

So, you have a benefits program and you want to compare it?

The most common questions and obstacles companies face in comparing benefits plans are:

- How do you compare plans (apples to apples) when the coverage is different?

- What will the costs at the next renewal be?

- Should you give your current broker, rep, agent, or advisor one last shot?

Comparing Plans When Coverage is Different

The onus here really falls on the advisor to break down the insurance jargon and provider nuances and formulas that you can easily understand. An experienced and effective advisor should be able to reduce the comparison quote(s) to such a level the only deviations you are left with are relatively minor (i.e. 1 hearing aid every 36 months vs. every 40 months).

If the advisor you are speaking to can’t break their comparison down to simple and easy to understand language for your comparison, they probably don’t have the knowledge, the expertise of level of care to work with you and your employees.

The Whipsaw Renewal Increase

Want to know a behind-the-scenes secret about employee benefits?

Here it is… your rates are probably right where they should be! You aren’t getting overcharged and you aren’t getting undercharged.

The benefits marketplace is too competitive for them to overcharge, the benefits companies have too many stakeholders to undercharge AND they all follow similar actuarial tables.

So my costs are where they should be? Yup!

And if I got a quote without changing coverage, my costs shouldn’t really change? Yup!

The big providers ( **** Life) might provide you a quote that says it will save you 15%. How does that work? The reality is they didn’t… they have given you a marketing discretion or a discount to obtain your business that they will just make up for at your next renewal.

Doing what you’ve always done will get you what you’ve always got… and if you saved 15% without doing anything different… brace yourself for your 30%+ increase at renewal!

So how do you prevent savings on your benefits plan from resulting in a major whipsaw increase?

Do things differently!

- Purchase the program more effectively

- Streamline your healthcare and dental supply chain

- Explore more effective funding methods

- Reduce or remove coverage that employees don’t value

NextGen Benefits can save clients on average 12% - 15% with value-added enhancements and proven stability of 4.5% increases at renewal. Book an appointment to find out how.

One More Chance

Picture this, you’ve had a plan in place with Advisor Kyle now for 3 years. You like Kyle, you were introduced by your cousin. He is responsive to emails and phone calls, he knows your kid's names, and he even took you golfing.

But you decide it is time to see if you are in the best hands — a general best practice that you follow with everything.

You find out that your costs could eliminate 1.5 months of your premium (12%), eliminate the double-digit increases you have been receiving, and improve your employees’ vision coverage.

Should you let Kyle have one more shot to keep your business?

Here are some questions worth asking of yourself and your business:

- Do you believe the people you do business with should always have you in the best position?

- Do you believe you should have to threaten the companies you pay in order to get the best results?

- Do you expect your clients to allow you to overcharge them, not work in their best interest, but then give you a chance to keep their business when they find something better?

Some relationships trump results… good luck firing your brother-in-law.

For all those times that the broker isn’t your brother-in-law we firmly believe in results-based relationships and consistently.

NextGen Benefits holds itself to this standard.

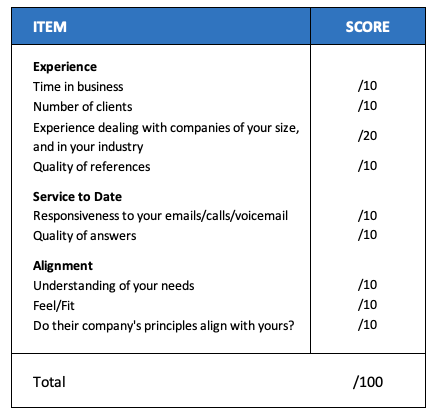

Finding The Right Employee Benefits Advisor for Small to Mid-Size Canadian Companies

When trying to understand the difference between different employee benefits advisors, it may help to think of them as a contractor.

Despite, for the most part having access to the same tools, a good contractor will know when to use the right tool at the right time.

They will know the right design and the right technique for each situation.

And finally, they will make the most efficient processes and foster the most beneficial relationships with their vendors.

Employee benefits advisors are no different than contractors.

The right employee benefits advisor will be able to tailor the benefits program to fulfill the unique needs of a business, at the right costs.

Whether it be a start-up benefits plan or changing a benefits plan, the right benefits advisor will implement the right workable innovations to ensure the program is cost-effective and stable year after year.

Our Commitment

NextGen Benefits is committed to providing business owners with straight-forward employee benefits plans.

Book an appointment with a skilled employee benefits advisor to put together a plan that is right for your business and your employees.